are taxes taken out of instacart

Plan ahead to avoid a surprise tax bill when tax season comes. I dont have any to suggest as I use a spreadsheet personally.

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

You can make quarterly deposits to the IRS if that makes it easier.

. Therere several apps out there. Find out the top deductions for Shoppers and more tax tips here. If you have special state-specific taxes these will be added to your fees.

For its part-time shoppers Instacart doesnt take out taxes and they file W-2s. Because Instacart shoppers are. To find out which of your items are.

Youll have to pay that 765 twice over for a total of 153. As youre liable for paying the essential state and government income taxes on the cash you make. You should put aside at least 15 every week of your gross to avoid surprises.

Heres how it works. Tax tips for Instacart Shoppers. Instacart shoppers use a preloaded payment card when they check out with a customers order.

As an Instacart driver though youre self-employed putting you on the hook for both the employee and employer portions. Tax withholding depends on whether you are classified as an employee or an independent contractor. Fees vary for one-hour deliveries club store deliveries and deliveries under 35.

So you get social security credit for it when you retire. The amount they pay is matched by their employer. Theres a whole mess of stuff that comes right off the top of the sum you took in before tax is applied.

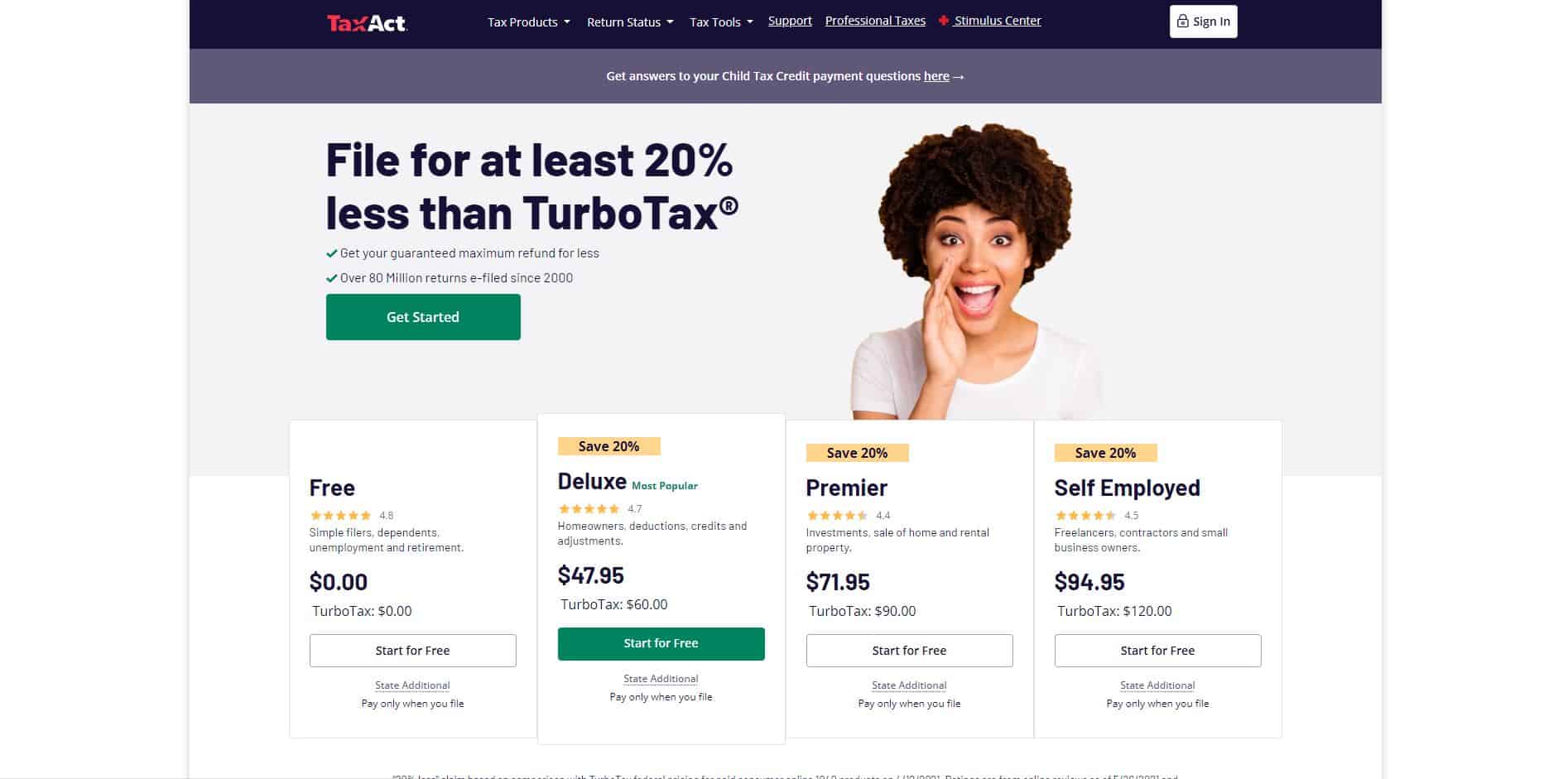

You can find the breakdown of specific fees below. Get the scoop on everything you need to know to make tax season a breeze. For simplicity my accountant suggested using 30 to estimate taxes.

31 out of 5 stars. Get answers to your biggest company questions on Indeed. Top Instacart Tax Deductions.

Deductions are important and the biggest one is the standard mileage deduction so keep track of your miles. Instacart delivery starts at 399 for same-day orders 35 or more. Instacart shoppers are required to file a tax return and pay taxes if they make over 400 in a year.

Work related gear such as carts follies cold bags support shoes. As long as you track your miles properly you dont owe too much. You are an independent contractor doing doordash and instacart so they do not take any taxes out of your pay.

For 2021 the rate was 56 cents per mile. For 2021 the rate was 56 cents per mile. Get weekly updates new jobs and reviews.

Does Instacart Take Out Taxes In 2022. Its a completely done-for-you solution that will help you track and. Instacart does not take out taxes for independent contractors.

You only see a tax refund if YOU send the IRS some money throughout the year. As an Instacart shopper here are seven deductions. Instacart fees and taxes.

You pay 153 SE tax on 9235 of your Net Profit greater than 400. You do get to take off the 50 ER portion of the SE tax as an adjustment on line 27 of the 1040. Tax tips for Instacart Shoppers.

Taxes and fees Like any other service or product taxes are included in the order total on your delivery receipt thats emailed to you upon the completion of your order. The 153 self employed SE Tax is to pay both the employer part and employee part of Social Security and Medicare. Happiness rating is 64 out of 100 64.

Instacart does not take out taxes for independent contractors. You can even write-off from your taxes the cost of hiring a tax professional if needed - this is optional if you seek out tax advice but highly recommended. Yes Instacart takes out tax and it means we can help you manage your tax obligations for you.

The estimated rate accounts for Fed payroll and income taxes. We suggest you put a reminder on your phone. Plan ahead to avoid a surprise tax bill when tax season comes.

To pay your taxes youll generally need to make quarterly tax payments estimated taxes. Learn the basic of filing your taxes as an independent contractor. Find answers to How are taxes taken from your check from Instacart employees.

You do get to take off the 50 ER portion of the SE tax as an adjustment on line 27 of the 1040. The taxes andor fees you pay for products purchased through the Instacart platform are calculated in the same way as in a brick and mortar store. W-2 employees also have to pay FICA taxes to the tune of 765.

I worked for Instacart for 5 months in 2017. Depending on your location the shipping or service charges you pay to Instacart in exchange for their services may also be taxable. Instacart is one of the most popular grocery delivery services out there.

Instacart doesnt take taxes out because its a contractor job which is understandable but what do yall do around tax season. Start of main content. If you pay attention you might have noticed they dont take that much out of your paycheck.

Instacart Shoppers weve put together a custom tax guide for you complete with insider tips from our tax specialists. If you are looking for a hands-off approach to dealing with your Instacart 1099 taxes try Bonsais 1099 expense tracker to organize your tax deductions online. The tax andor fees you pay on products purchased through the Instacart platform are calculated the same way as in a.

Instacart usually wont take out taxes since youre an independent contractor and have to pay estimated taxes. Instacart charges fees based on the services being offered.

How To Handle Your Instacart 1099 Taxes Like A Pro

What You Need To Know About Instacart Taxes Net Pay Advance

Instacart Taxes The Complete Guide For Shoppers Ridester Com

Instacart 1099 How To Get One Filling One Out Faqs

Instacart Taxes The Complete Guide For Shoppers Ridester Com

Does Instacart Take Out Taxes In 2022 Full Guide

How To Get Instacart Tax 1099 Forms Youtube

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

Taxes For Grubhub Doordash Postmates Uber Eats Instacart Contractors

Instacart Taxes The Complete Guide For Shoppers Ridester Com

What You Need To Know About Instacart Taxes Net Pay Advance

Does Instacart Track Mileage The Ultimate Guide For Shoppers

What You Need To Know About Instacart Taxes Net Pay Advance

What You Need To Know About Instacart 1099 Taxes

Instacart Taxes The Complete Guide For Shoppers Ridester Com

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

Reporting Income On Taxes 2021 Doordash Uber Eats Grubhub Instacart

Guide To 1099 Tax Forms For Instacart Shoppers Stripe Help Support