does california have real estate taxes

Property tax in California is calculated by something called Ad Velorum. In California retirement accounts and pension plans are.

California Estate Tax Everything You Need To Know Smartasset

The value of an estate is determined by.

. However California residents are subject to federal laws governing gifts during their lives and their estates after they die. Do I have to pay transfer tax on a refinance in California. Tax amount varies by county.

California real property owners can claim a 7000 exemption on their primary residence. The federal estate tax goes into effect for. The tax rate is 1 of the total home.

In California an estate worth at least 184500 must by law open a probate case with the court according to California inheritance laws. A capital gain from the sale of real estate located in CA is CA-source income. In California a single taxpayer can save up to 250000.

So for a 300000 house the transfer tax due will be 330. Homeowners age 62 or older can postpone payment of property taxes. The California Revenue and Taxation Code has set this tax for all counties at 110 per 1000 or 055 per 50000 to.

This reduces the assessed value by 7000 saving you up to 70 per year. The best way to avoid capital gains tax on the sale of your California residential real estate is to take full advantage of the exemption. The governing withholding laws California Code of Regulations Title 18 Sections 18662-0 through 18662-6 and Section 18662-8 were revised and were effective as of November.

You must have an annual income of less than 35500 and at least 40 equity in your home. October 2 2019 921 AM. You should claim the.

Volunteer Income Tax Assistance VITA if you. 074 of home value. That means taxes are calculated by the value of the home.

The median property tax in California is 283900 per year for a home worth the median value of 38420000. If you live in California you can get free tax help from these programs. Property 2 days ago 8.

Get free tax help FTBcagov - California. You can pro-rate any unpaid property taxes with your buyer until you finish the escrow on the house sale. It doesnt stop there however as cities within the state.

If you own the investment property for more than a year and pay the long-term capital gains tax it will be taxed at 0 15 or 20 depending on your income level. Interestingly California has property taxes that are below the. California taxes non-residents on CA-source income.

Even though you wont owe estate tax to the state of California there is still the federal estate tax to consider. California does not have an inheritance tax estate tax or gift tax. Californias current transfer tax rate is 11 for every 1000.

Federal Estate Tax. Even though California does not have its own estate and inheritance taxes it is still one of the highest tax states in the country.

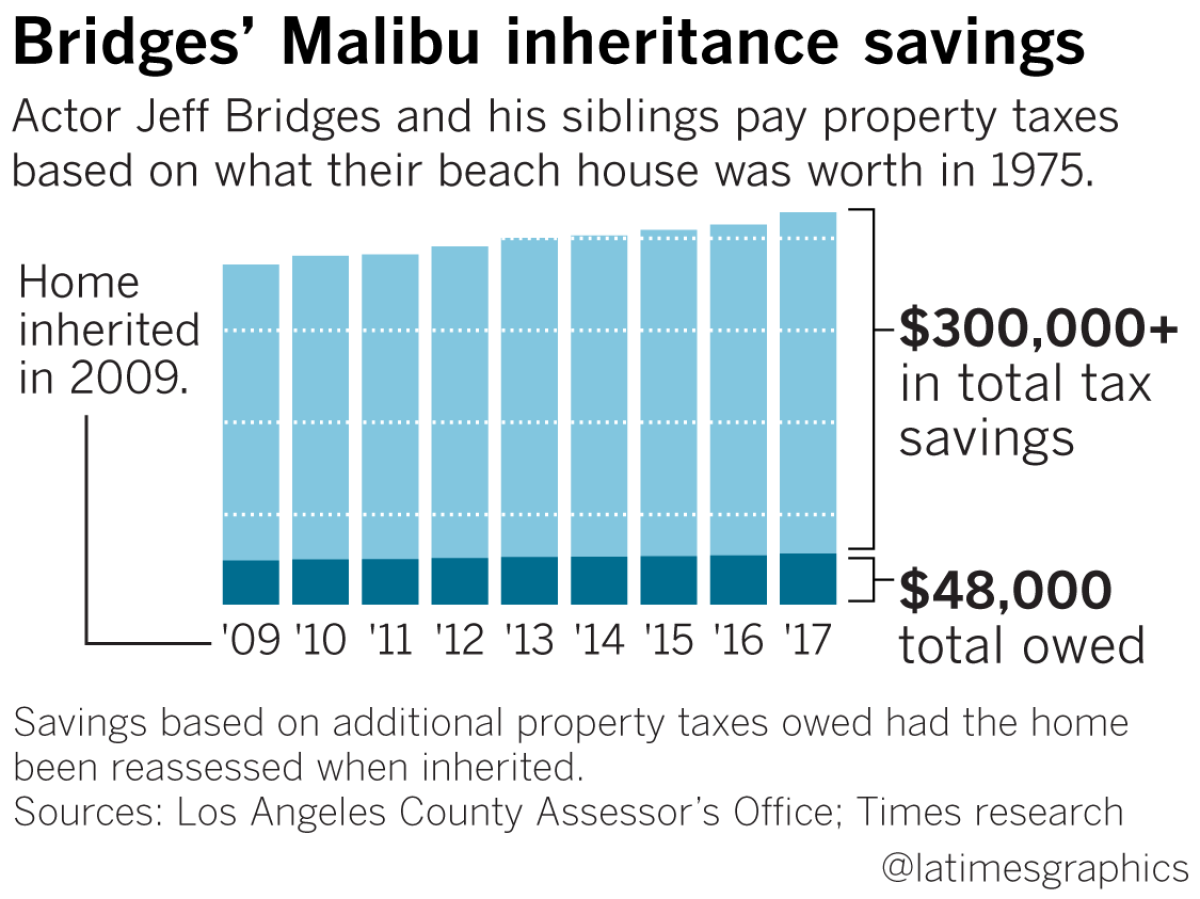

California Homeowners Get To Pass Low Property Taxes To Their Kids It S Proved Highly Profitable To An Elite Group Los Angeles Times

Property Tax California Style 9780966331073 Bone Cpa James S Bone James Books Amazon Com

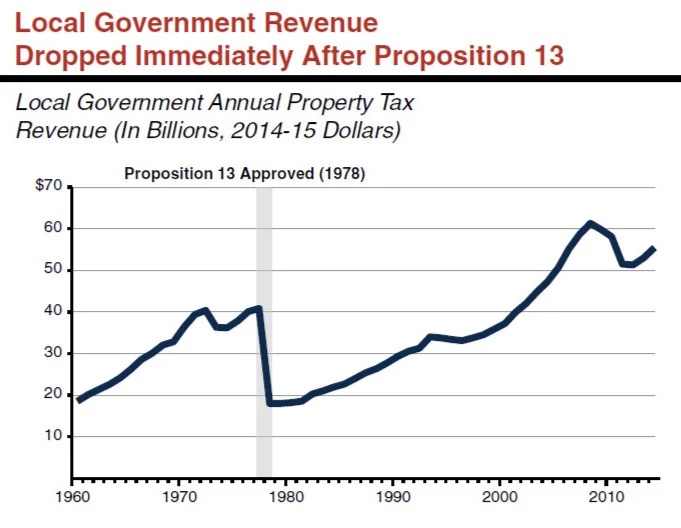

Understanding California S Property Taxes

Learn How California Property Taxes Are Distributed Controller Treasurer Department County Of Santa Clara

California Property Taxes Top Financial Secrets

California Property Taxes Explained Big Block Realty

Residential Real Estate Tax Rates Arizona Real Estate Notebook

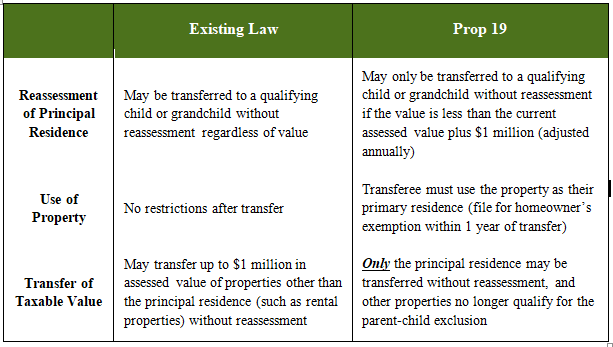

The Property Tax Inheritance Exclusion

The Real Estate Tax Implications Of California Prop 19 Certified Tax Coach

Understanding California S Property Taxes

Understanding California S Property Taxes

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Will Your California Property Tax Skyrocket In 2020 Wynnecre Orange County Commercial Real Estate Experts

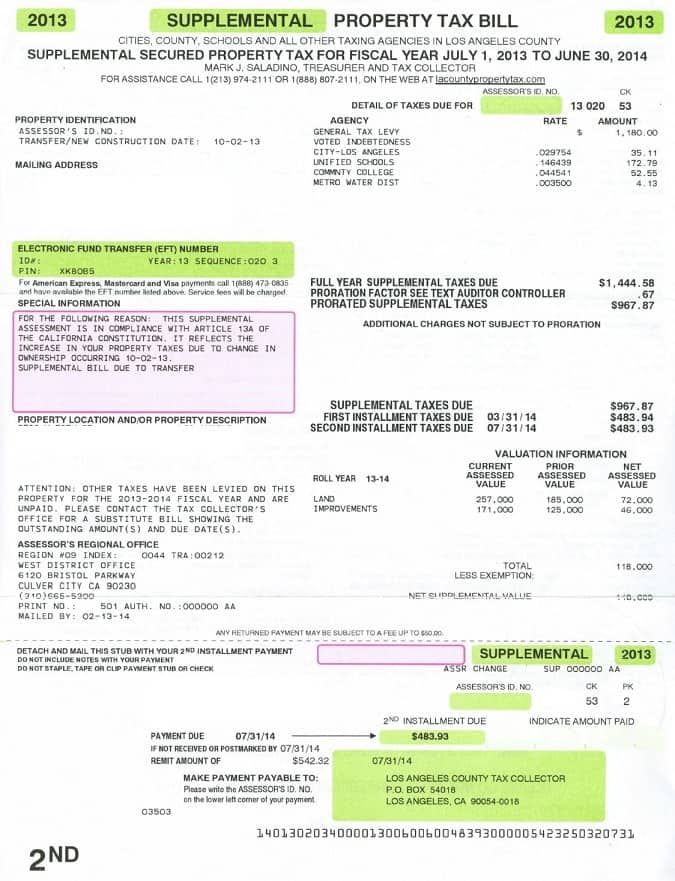

Los Angeles Supplemental Property Tax Bill James Campbell Los Angeles Real Estate Agent

County Of Marin Department Of Finance Where Your Property Tax Dollars Go

California Real Estate Taxes The Potential Impact Is Tremendous Workanswers

The Ultimate Guide To California Real Estate Taxes

Property Taxes And Assessments Division Auditor Controller Stanislaus County

California Tax Rates Rankings California State Taxes Tax Foundation